Traditional ira to roth ira conversion calculator

The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of one or more non-Roth IRAs ie traditional. Schwab Is Here To Answer Your Questions And Help You Through The Process.

Traditional Vs Roth Ira Calculator

IRA to Roth Conversion Calculator This calculator that will help you to compare the estimated consequences of keeping your Traditional IRA as is versus converting your Traditional IRA to.

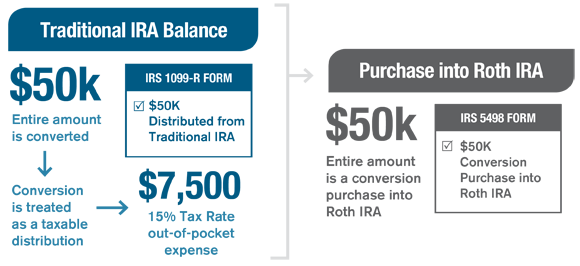

. Traditional IRA depends on your income level and financial goals. Use this Roth IRA conversion calculator to project the inflation-adjusted value of your Traditional IRA or 401k at retirement versus the inflation-adjusted value of the same funds at retirement. Conversion from traditional IRA to Roth IRA is a very simple process but there are a couple of things you should know beforehand.

Discover if a Roth IRA conversion will work for your portfolio in 99 Retirement Tips. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Choosing between a Roth vs.

Roll Over Into A TIAA Traditional IRA Get A Clearer View of Your Financial Picture. There are many factors to consider including the amount to convert current tax rate and your age. Ad Visit Fidelity for Retirement Planning Education and Tools.

Roth IRA Conversion Calculator In 1997 the Roth IRA was introduced. New Look At Your Financial Strategy. Enter your age today or the age you will be when you convert the IRA.

An IRA can be an effective retirement tool. Use this Roth IRA conversion calculator to project the inflation-adjusted value of your Traditional IRA or 401k at retirement versus the inflation-adjusted value of the same. The Standard Poors 500 SP.

Inputs to the Conversion Tool. Here are the inputs to edit. The Roth IRA and the traditional IRA.

Take Advantage Of The After-Tax Benefits. Roth vs Traditional 401k Calculator. Reviews Trusted by Over 45000000.

Converting to a Roth IRA may ultimately help you save money on income taxes. Roth IRA conversion with distributions calculator. An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

Roth Ira Conversion Methods. Enter your age when youll start. The actual rate of return is largely dependent on the types of investments you select.

There are several ways to enact a Roth conversion depending on where you hold your retirement accounts. Compare 2022s Best Gold IRAs from Top Providers. Ad TIAA IRAs Can Give You The Flexibility And Convenience You May Need.

Not everyone is eligible to contribute this. Use this Roth vs. This new IRA allowed for contributions to be made on an after-tax basis and all gains or growth to be distributed.

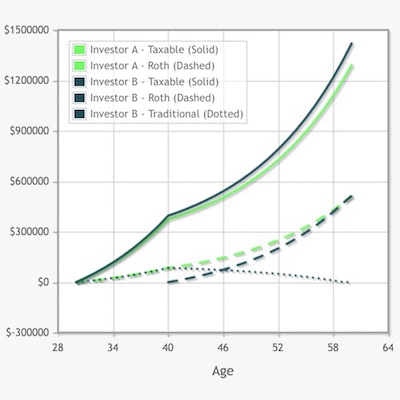

Roth IRAs are a popular way for people to save for retirement. Ad Find Out If A Roth IRA Conversion Is For You. Use this calculator to see how converting your traditional IRA to a Roth IRA could affect your net worth at retirement.

Get a list of investment prosno commitments you choose when youre ready. Once converted Roth IRA plans are not subject to required minimum distributions RMD. Ad Get help catching up on retirement or building a long-term investing plan.

There are two basic types of individual retirement accounts IRAs. This calculator assumes that your return is compounded annually. Instead of letting you defer taxes until you make.

First off there is a big difference between a traditional. Converted plan balance is allowed to grow tax-free and all withdrawals are tax-free as well. Ad Read Tip 91 to learn more about Fisher Investments advice regarding IRA conversions.

Ad Visit Fidelity for Retirement Planning Education and Tools. Roth 401k contributions are a relatively new type of 401k that allows you to invest money after taxes and pay no taxes when funds are withdrawn. With a 60-day indirect rollover you.

They offer roughly the opposite tax benefits of traditional IRAs. Visit The Official Edward Jones Site. The information in this tool includes education to help you determine if converting your.

Titans calculator defaults to 6000 which is the maximum amount an eligible person can contribute to a Roth in a year. For instance if you expect your income level to be lower in a particular year but increase again in later years. Traditional IRA Calculator can help you decide.

Traditional Vs Roth Ira Calculator

Download Roth Ira Calculator Excel Template Exceldatapro

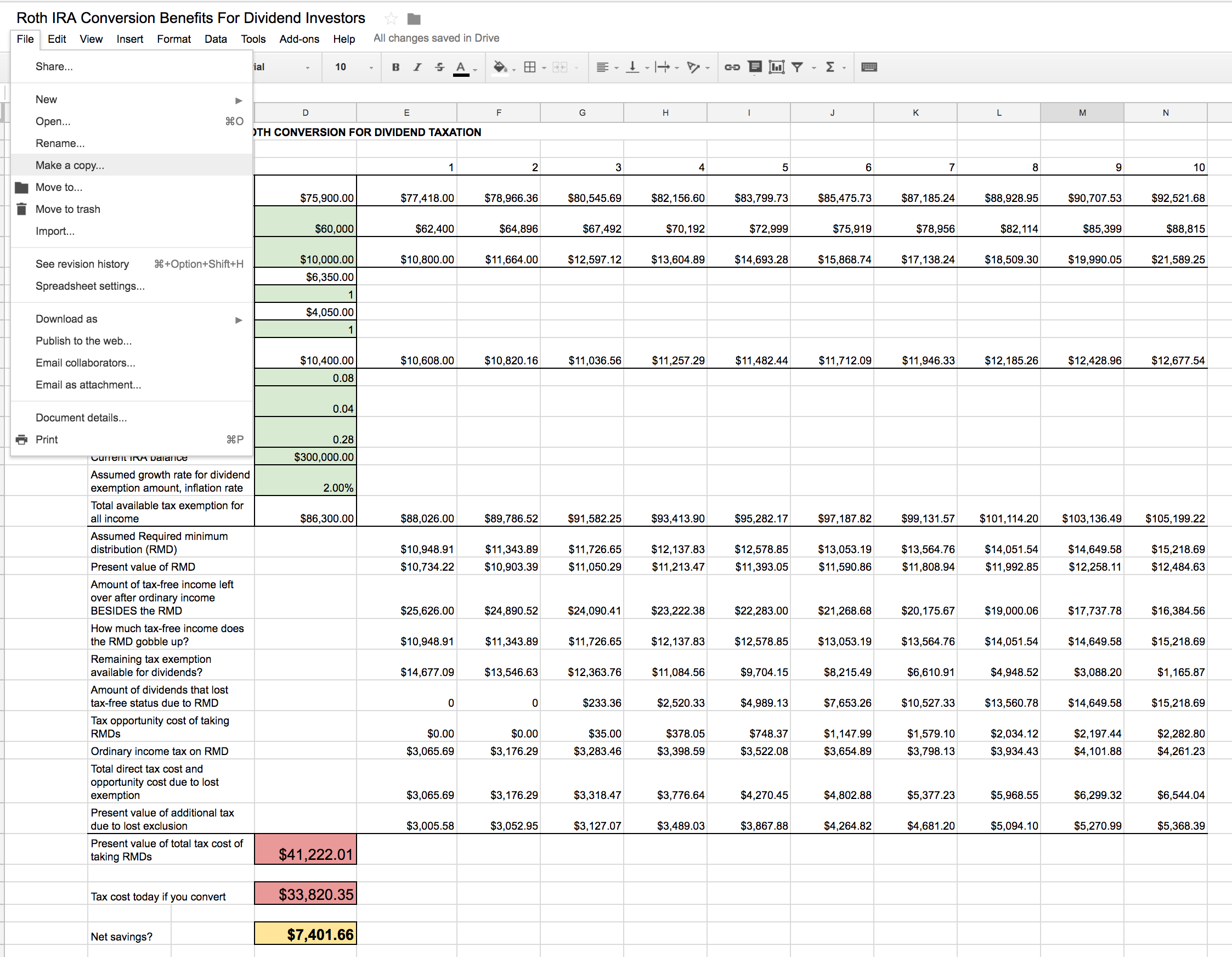

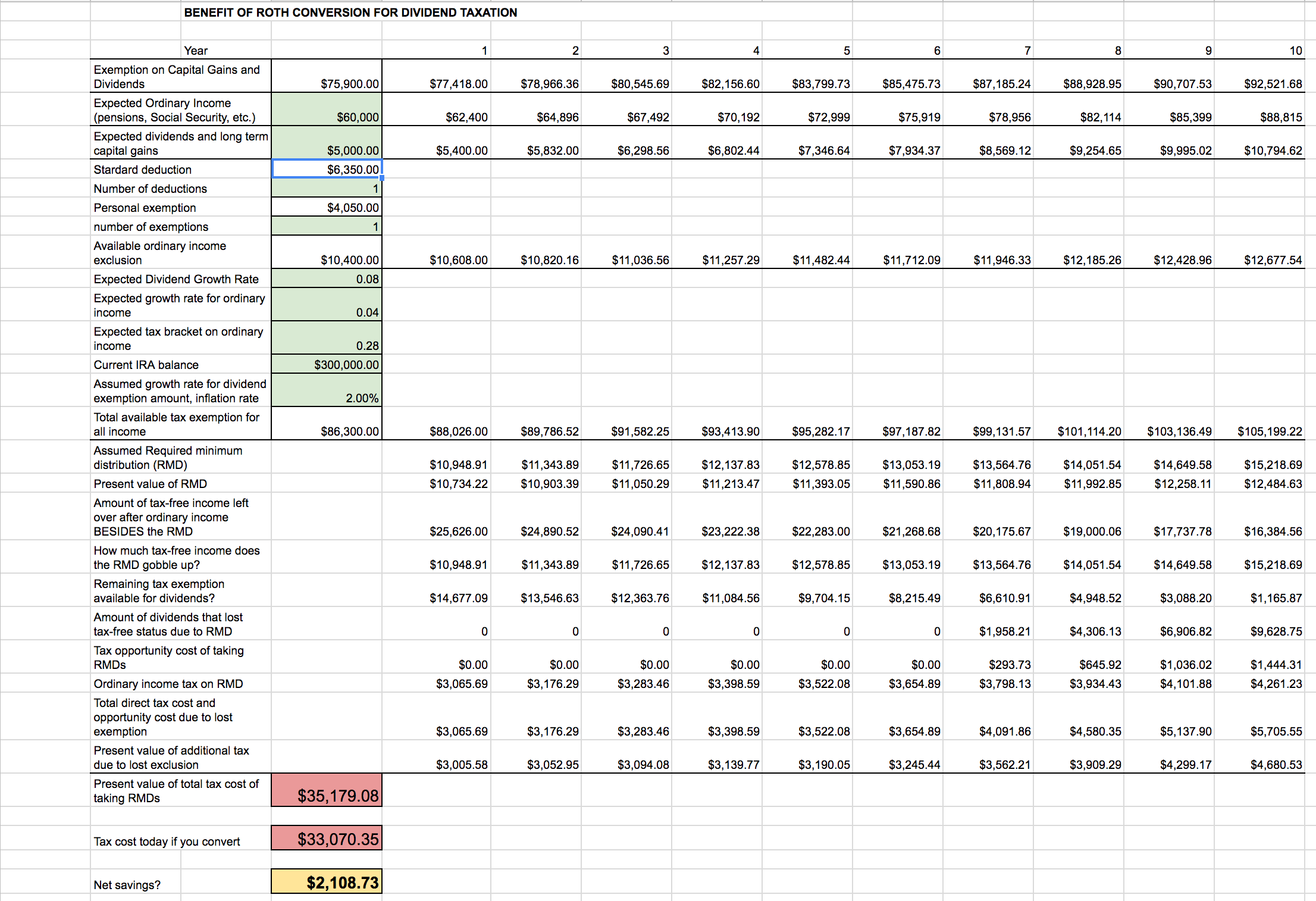

Roth Ira Conversion Spreadsheet Seeking Alpha

Roth Ira Conversion Spreadsheet Seeking Alpha

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Traditional To Roth Ira Conversion Calculator Keep Or Convert

Converting Your Traditional Ira Janus Henderson Investors

Systematic Partial Roth Conversions Recharacterizations

Roth Ira Conversion How To Convert Without Losing Money Or Paying Taxes

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

How I M Using A Roth Ira Conversion Ladder To Access Retirement Funds Early A Step By Step Guide A Purple Life

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculators

Traditional Ira Vs Roth Ira The Best Choice For Early Retirement

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most